inheritance tax changes 2021 uk

Key points from Budget 2021. The government has announced that the inheritance tax IHT threshold will remain frozen at 325000 until 20252026.

The Proposed Changes To Cgt And Inheritance Tax For 2021 2022 Bph

Gifts in excess of 30000 would be taxed at 10.

. Reducing the annual allowance would mean more people. The aim is that from 1 January 2022 more than 90 of non-taxpaying estates will no longer have to complete. The estate can pay Inheritance Tax at a reduced rate of 36 on some assets if.

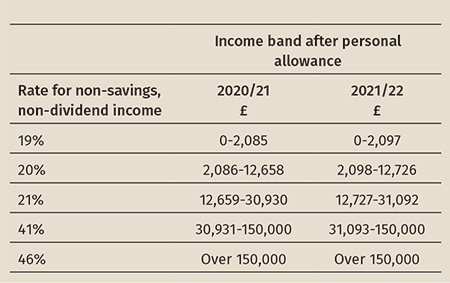

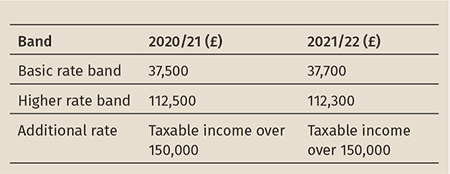

Whilst these proposals may look good on the surface the devil is in the detail. These included aligning rates of CGT to income tax levels and cutting the annual gains allowance from 12300 to as little as 2000 per person but with fewer assets attracting the charge. There is no federal inheritance tax but there is a federal estate tax.

Assets needed to be sold to pay inheritance tax for higher rate taxpayer. In addition the residence nil-rate band will also be frozen at 175000When added to the IHT threshold of 325000 it allows each individual to pass on 500000 with no IHT payable - or 1m per couple. In some instances IHT bills could.

Annual allowance of 30000 which cannot be carried forward. In accordance with the new changes if a person has died on or after 1 January this year only the value of their estate needs to be reported when applying for a probate. In 2021 the government implemented changes to the inheritance tax nil-rate band saying that current nil rate bands would remain at existing levels until April 2026.

The Government has previously announced that the inheritance tax IHT threshold will remain frozen at 325000 until 20212022. 15 October 2021 1423. There is a tapered.

The government will introduce legislation u202fso that theu202finheritance tax nil-rate bands will remain at existing levels until April 2026. There are currently two tax-free allowances for inheritance. In March 2021 the government announced changes in IHT which will become effective from January 2022.

They aim to make the Statutory Instrument accessible to readers who are not legally. 05 March 2020 1145. Find out more.

For gifts of cash the donor would be required to withhold 10 of the gift to pay the tax. The Inheritance Tax charged will be 40 of 175000 500000 minus 325000. In the current tax year 202223 no inheritance tax is due on the first 325000 of an estate with 40 normally being charged on any amount above that.

Tax Day on 23 March 2021 announced that the excepted estates rules would be changed. ICAEW technical editor Lindsey Wicks looks at the effects as more than 90 of non-taxpaying estates will no longer have to complete full inheritance tax accounts. Will Inheritance Tax Change In 2021.

Explanatory Memorandum sets out a brief statement of the purpose of a Statutory Instrument and provides information about its policy objective and policy implications. In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from 18 to 40. For exempt estates the value limit in relation to the gross.

However what is charged will be less if you leave behind your home to your direct descendants such as children or grandchildren. Inheritance tax IHT is levied on an estate when a person has died and is passing on assets so long as the estate in question is valued higher than 325000. Inheritance tax Currently an individual can pass on 325000 of their wealth tax-free to their loved ones.

Inheritance Tax Changes in 2022. There is normally no Inheritance Tax to pay if someone leaves everything above the 325000 threshold to their spouse or civil partner Image. The Government is set to introduce legislation in Finance Bill 2021 so that the inheritance tax nil-rate bands will remain at existing levels until April 2026.

The residential nil rate band is available on top of the existing inheritance tax free allowance of 325000 meaning that individuals will be. Reducing the IHT tax rate of 40 to a rate of 10 for estates up to 2m 20 for estates over 2m. The Inheritance Tax Delivery of Accounts Excepted Estates Amendment Regulations 2021.

In April 2017 the Government introduced an additional nil-rate band when a residence is passed on death to a direct descendant. If the person died on or before 31 December 2021 no IHT205 form needs to be completed if it is an excepted estate or they do not need a probate. Taxes are never popular but Inheritance Tax IHT is arguably subject to more criticism than any other.

The Office of Tax Simplification OTS has made some recommendations and proposals to overhaul Inheritance Tax IHT. The limit for chargeable trust property is increased from 150000 to 250000. 2 These Regulations shall come into force on 1st January 2022 and shall have effect in relation to deaths occurring on or after that day.

Citation commencement effect and interpretation. Tax rates and allowances. 15 October 2021 1423.

Assets needed to be sold to pay inheritance tax for basic rate taxpayer. The OTS review of CGT published in September suggested four key changes as part of an overhaul. Budget 2021 - Changes to Inheritance Tax Posted on 29th April 2021 at 1236 With the Chancellor announcing in the budget this year that the inheritance tax thresholds will be frozen at the existing levels until April 2026 have you made the most of your tax free allowances.

There is also a 175000 allowance for. Inheritance Tax changes. There are currently two tax-free allowances for inheritance.

The rate remains at 40. Often referred to colloquially as death tax it is a levy that is placed on estates that are worth more than the IHT threshold. Initially this was set at 100000 but rises to 175000 in.

Assets needed to be sold to pay inheritance tax for additional rate taxpayer. Inheritance tax nil-rate bands maintained until 2026. Inheritance Tax Changes - What You Need To Know.

1 These Regulations may be cited as the Inheritance Tax Delivery of Accounts Excepted Estates Amendment Regulations 2021.

Corporation Tax Income Forecast Uk 2021 Statista

How Much Inheritance Tax Will I Pay In 2022 And How Can I Reduce Or Avoid It

Uk Property Investment In 2021 Where To Invest Investment Property Inheritance Tax

Why Capital Gains Tax Reform Should Be Top Of Rishi Sunak S List Autumn Budget 2021 The Guardian

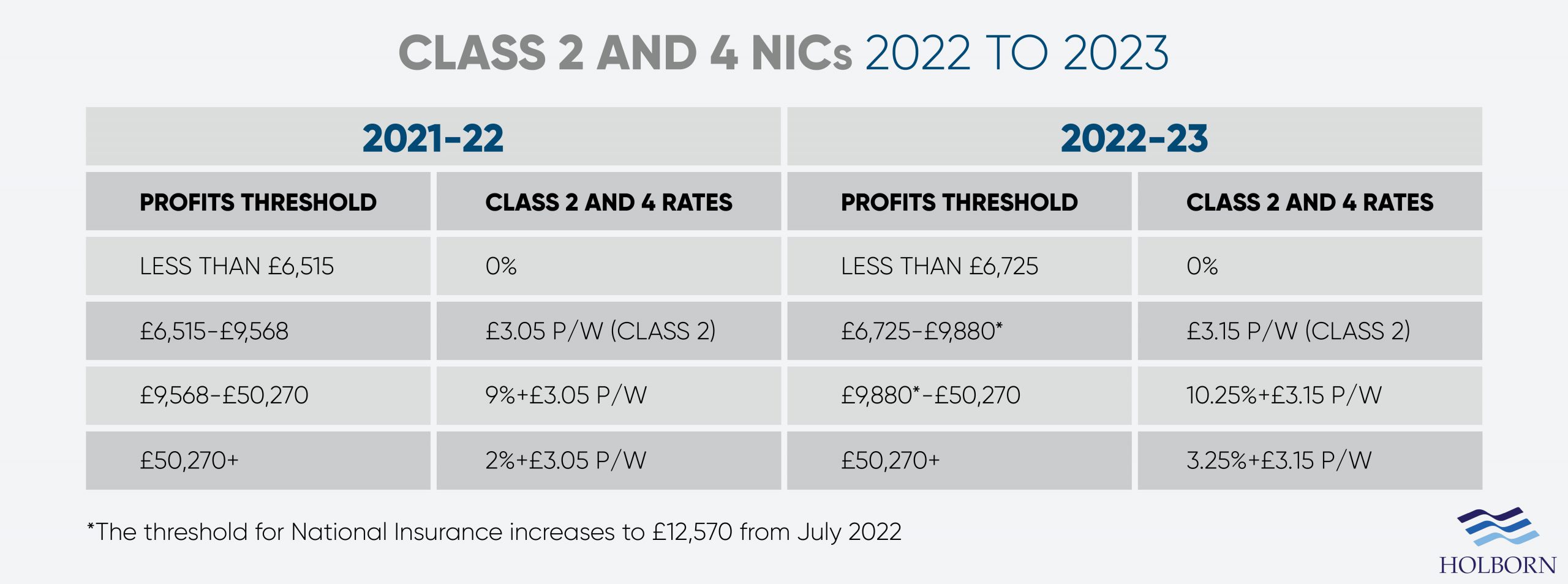

Changes To Uk Tax In 2022 Holborn Assets

Inheritance Tax Planning May 2022 Uk Guide

Are Uk Inheritances Taxed In France Harrison Brook

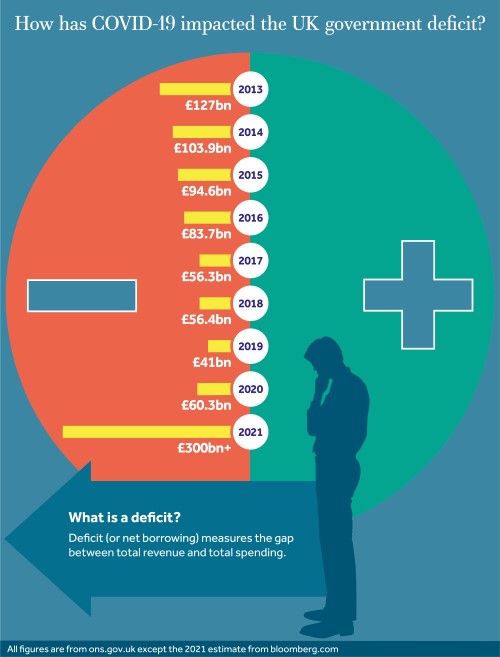

Will Uk Inheritance Tax Increase Because Of Covid 19 Stellar Am

How Does The Personal Representative Deal With The Income And Capital Gains Arising After The Deceased S Death Low Incomes Tax Reform Group

Changes To Uk Tax In 2022 Holborn Assets

How To File Your Uk Taxes When You Live Abroad Expatica

Post Covid 19 Tax Planning Be Prepared For Tax Rises Cgwm Uk

Once Your Ehic Card Has Expired You Can Apply For A Ghic Card Uk Global Health Insurance Card Health Care Free Health Insurance Health Care Programs

Inheritance Tax Receipts Uk 2022 Statista

Inheritance Tax Advice For Expats And Non Uk Residents Experts For Expats